Solar tax credits are a great way to help offset the cost of adding a system to your home. The current 30% federal solar tax credit began in 2022 and will remain in place through 2032. In 2033, credits begin to decline until they expire in 2035 unless action is taken by Congress. That means now is the best time to invest in solar power to take advantage of the current tax credits.

Specific requirements are needed to get the tax credits, but there are pieces of a whole home solar system that you may not know are included. It is important to note that there is no limit to the amount you can claim.

Specific requirements are needed to get the tax credits, but there are pieces of a whole home solar system that you may not know are included. It is important to note that there is no limit to the amount you can claim.

The credits can also only be claimed once on the original installation. If you are buying a home with solar, you should speak to the owners to find out if the credit has already been claimed.

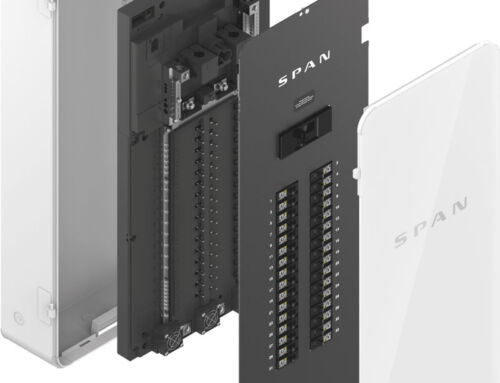

Some of the things that qualify for the credit include solar panels, solar pool heating systems, installation, labor and certain material costs, battery storage systems, and sales taxes. Your system does not have to be connected to the grid or on your roof to qualify.

Additional Solar Tax Credit Eligibility

Renters, condo owners, and vacation homes can also get the 30% solar tax credits. Renters and condo owners are eligible for credit for the amount they contribute to the cost of a system they are a stakeholder in. In other words, you must have some ownership rights to the system. If your landlord installs the system and you do not have an ownership stake, then you cannot claim credit.

Vacation homes and second homes are eligible for the 30% tax credit. The exception is if the second property is classified as a rental property. In that case, you may qualify for a business solar tax credit.

If you want to add solar to your home and take advantage of the current solar tax credits, Stilwell Solar is here to help. We are local experts ready to help get the system that best meets your needs. We can also help you understand your tax credit eligibility. Contact us or call (239) 495-5988 to learn more.